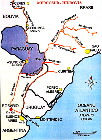

From a grain-producing perspective, the hinterland of the city of Rosario,

Argentina is called the Rosafe Area; in other words, it's an area that

produces and grinds grain that's exported by shipping units located on a

strip of land on the right bank of the Parana River running from Puerto

San Martin (25 miles north of Rosario) to Villa Constitucion (25 miles to

the south).

From a grain-producing perspective, the hinterland of the city of Rosario,

Argentina is called the Rosafe Area; in other words, it's an area that

produces and grinds grain that's exported by shipping units located on a

strip of land on the right bank of the Parana River running from Puerto

San Martin (25 miles north of Rosario) to Villa Constitucion (25 miles to

the south).

In so far as grain exports and its by-products are concerned, this area ranks number one in the country, accounting for between 65 - 70% of the actual grain export total (a larger proportion in terms of money volume).

Soy is the most important among grain products. It has become the one with the highest economic impact for Argentina, with exports totalling in excess US$2.2 billion.

In order to fully appreciate this, we'll supply some data and figures: World soy production reached some 115 million tons during the 1993/94 season.

The U.S. was the top producer with slightly over 49 million tons. The number two spot went to Brazil with almost 25 million tons. China came in third with approximately 13 million tons, and Argentina ranked fourth with a record figure of 11.5 million tons.

It's also worth noting that Paraguay and Bolivia, Argentina's neighboring countries, each produced 1.75 million tons and 5.15 million tons respectively. Total Latin American production reached just over 38 million tons.

Santa Fe province produced almost 5 million tons. Cordoba province production of almost 2.9 million tons - most of it shipped out through nearby ports - is also significant, as well as that of districts in northern Buenos Aires province, which produced almost 2.5 million tons.

As these figures point out, large part of Argentina's soy production is centered around the Rosafe Area, and most of it is handled by cooking oil processing facilities around Rosario.

Argentina has the capacity to grind just over 19 million tons of oil-producing seeds per year. Over half that capacity is concentrated in Santa Fe province, and regarding soy processing, over 75% of it is located there.

Oil seed production reaches about 15.5 million tons with about 3 million tons of that total exported as unprocessed seed or bean, thus leaving close to 12.5 million tons for processing.

This represents 65% of available capacity, and it denotes an "under-supplied" oil seed market. This is one of the reasons that dictated Argentina's widespread business practice of delivering grains to processing plants at harvest time, with prices subsequently pegged by producers.

Argentina consumes very little of its own soy production. Most of it (95%) is exported either as bean, flour [pellets], and oil.

As it was noted earlier, a large part of grain shipments (65 -70%) is shipped out from ports in the Rosafe Area, but that figure is higher still (approximately 85%) if narrowed down to soy production only. Shipping is done by a dozen highly efficient private units which in the last 14 years have caused freight costs to decrease from US$7.5 per ton to US$2.0/2.5 per ton currently charged.

It's worth comparing these private port freight costs with the US$8 or higher charged at Brazilian ports.

Likewise, it's also worth noting that calls for bids have recently gone out for dredging to a depth of 32 feet and buoying the stretch from Puerto San Martin to the sea (and the stretch from Santa Fe to Puerto San Martin to a depth of 22 feet).

This bidding is now in the process of being awarded. This project would allow many vessels that currently pick up partial loads up river at Parana ports and then complete loading at Bahia Blanca, Quequen in top-off operations on the Rio de la Plata River or on Brazilian ports (mostly Paranagua) to depart fully loaded from the Rosafe Area.

As a result, current freight would drop, ultimately benefitting the private sector.

Unlike other areas in Argentina and Brazil, the fact that the Rosafe Area is a major commodities hub allows the available market price to be quoted from the Bolsa de Comercio de Rosario [Rosario Commerce Exchange] (a market that, as mentioned earlier is undersupplied) as a valid reference tool for negotiations.

It's also useful in preparing an index for completing cash settlement operations in a futures or settlement market.

In this regard, the Indice Soja Rosafe [Rosafe Soy Index] has become the world's first grains tool of its kind because of its many advantages in comparison with the traditional system of delivery.

In previous paragraphs we've seen the importance of the Rosario Area from a grain-producing perspective, especially in soy production, grinding and export, in addition to its strategic location as a "gateway" for importing and exporting goods to and from population centers located near the Paraguay-Parana Waterway.

This 2,150 mile [3,440 km] long waterway begins at Porto Caceres (Mato Grosso), Brazil. In its lengthy course, it crosses economically important areas due to their current production and their future potential.

Such is the case of the soy crop in the Brazilian states of Mato Grosso and Mato Grosso do Sul, which together with other neighboring states produce nearly 10 million tons of this oil seed.

Bolivia's participation is also significant (since it has access to the waterway through the Tamengo Canal), as well as that of Paraguay (that has direct access).

Corn and other grain crops, fruits, lumber and other vegetables have a promising future.

Iron and manganese deposits are mined near the Brazilian city of Corumba. These are some of the most important in the world, second only to those in Kursk (Russia). These deposits are: Urucum (Brazil) and Mutun (Bolivia).

Considerable settlement has been taking place in the vicinity of the waterway, such as the city of Cuiaba (Brazil) to the north.

Some of these communities have grown in spite of the long distance to the Atlantic coast, which involves their paying extremely high freight charges for incoming and outgoing goods.

They've developed in spite of this disadvantage, which forecasts a bright future for them when their natural drive is propelled by increased contacts with other areas via tug river transportation.

For example, let's consider that freight charges for transporting soy from the states of Mato Grosso and Mato Grosso do Sul to the port of Paranagua on the Atlantic coast are US$60 or more per ton, and they've been higher in some instances.

Although construction of a railway has recently been undertaken, its final completion is a long way away.

The Paraguay-Parana Waterway will have to connect with the Parana-Tiete Waterway in the future. The latter ends near the city of Sao Paulo.

In this regard, Brazil has made tug transportation a priority by building a series of locks (two were opened in Tres Irmaos some months ago and another one will open soon at Jupia) linking tug transportation.

In addition to some minor construction, there is still a lock to be built at Itaipu which would allow tug transportation over a stretch almost 3,700 miles [6,000 km] long.

All this would lead to a significant decrease in freight charges. The stretch of the lower Parana River, along which sits the Rosafe Area, is the end of the above-mentioned waterways and would serve as an entry and exit point for large overseas ships.

This is why completion of dredging to a depth of 32 feet from Puerto San Martin to the open ocean mentioned earlier will have a significant economic impact.

This stretch would link world trade with much of the interior regions of Argentina, Paraguay, Bolivia, and Brazil.

This relationship is of vital importance for trade within Mercosur, considering that once Brazil implements the Plan Real, a realignment between the Brazilian real and the Argentine peso, it may offset Argentina's large balance of trade deficit which exists today.

The Rosafe Area is not just a transfer point. Development of the Paraguay-Parana Waterway will also make it feasible for its seed processing facilities, with their current excess capacity, to process foreign grain. This will yield better milling margins and, as a result, better prices for the producer.

From this perspective, the adjustment of customs regulations in our country is critical to the implementation of grain import operations from other countries in order to grind the product in Argentine mills located on the right bank of the Parana River and to re-export the resulting by-products.